GST Rates for Pharmaceutical Products

What is GST?

It is an Indirect Tax which has replaced a lot of Indirect Taxes in India. GST is one indirect tax for the entire country. The GST (Goods and Services Tax) was passed in the Parliament of India on 29th March 2017 and it came into effect on 1st July 2017.

What are the components of GST?

There are 3 taxes applicable under this system: CGST, SGST & IGST.

CGST: Collected by the Central Government on an intra-state sale (Eg: transaction happening within Karnataka)

SGST: Collected by the State Government on an intra-state sale (Eg: transaction happening within Karnataka)

IGST: Collected by the Central Government for inter-state sale (Eg: Karnataka to Kerala)

GST rates for Pharmaceutical Products

From July 1, 2017, following GST slabs are applicable to all the pharmaceutical products. We have categorized the products with their respective GST Rates.

GST Rates for Pharmaceutical Products @Nil

- Nil for Human Blood and its elements

- Nil for All types of contraceptives

GST Rates for Pharmaceutical Products @5%

- 5% for Human Blood or Animal Vaccines

- 5% for Diagnostic tools for detection of all types of hepatitis

- 5% for Desferrioxamine deferiprone or injection

- 5% for Cyclosporin

- 5% for Medicaments (including veterinary medicines) used in bio-chemic systems and not having a brand name

- 5% for Oral re-hydration salts

- 5% for medicines including their salts and esters and diagnostic test kits, defined in List 3/List 4 appended to the notification No.12/2012- Customs dated the 17th March 2012.

- 5% for Formulations manufactured from the bulk drugs defined in List 1 of notification No.12/2012 - Central Excise, dated the 17th March 2012.

GST Rates for Pharmaceutical Products @12%

12% for All goods not defined elsewhere including

a) Drugs (excluding goods of heading 30.02, 30.05 or 30.06) consisting of two or more components which have been mixed collectively for prophylactic or therapeutic uses, not put up in estimated doses or in forms or packings for retail sale, including Siddha, Unani, Ayurvedic, homeopathic or Bio-chemic systems medicaments

b) Drugs (excluding goods of heading 30.02, 30.05 or 30.06) consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses (including those in the form of transdermal administration systems) or in forms or packings for retail sale, including Ayurvedic, homoeopathic Siddha or Biochemic, Unani, systems medicaments, put up for retail sale

c) 12% for Wadding, bandages, gauze, and similar articles (for example, adhesive plasters, dressings, poultices), impregnated or coated with pharmaceutical substances.

d) 12% for forms or packings for retail sale for surgical, medical, dental or veterinary purposes

e) 12% Pharmaceutical products specified in Note-4 to this Chapter such as Sterile surgical catgut, similar sterile suture materials and sterile tissue adhesives for surgical wound closure; sterile laminaria and sterile laminaria tents; sterile absorbable surgical or dental haemostatics; sterile surgical or dental adhesion barriers, whether or not absorbable, etc., Waste pharmaceuticals (other than contraceptives)

GST Rates for Pharmaceutical Products @18%

- 18% for Nicotine polacrilex gum.

Do you know what is the process of GST registration or how to file GST return?

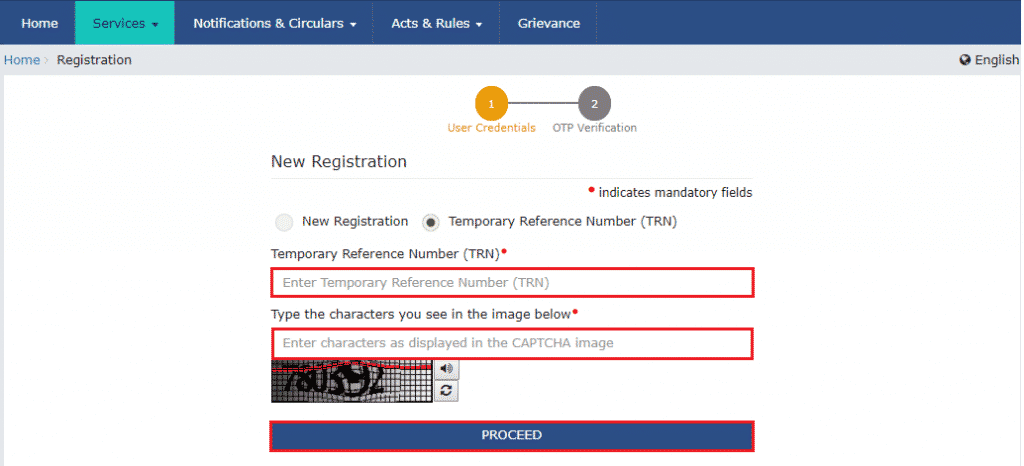

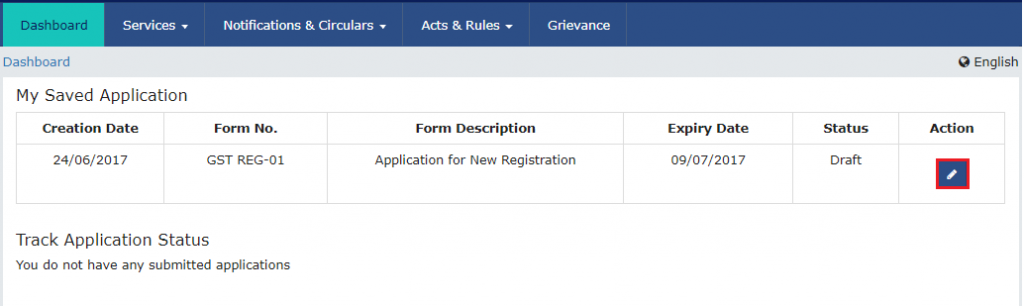

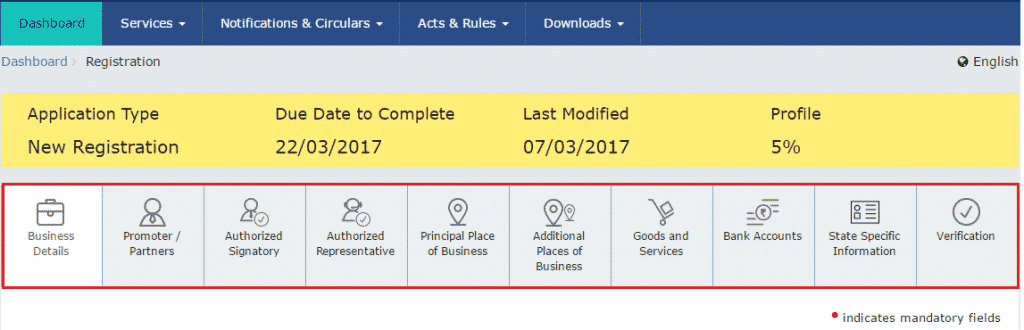

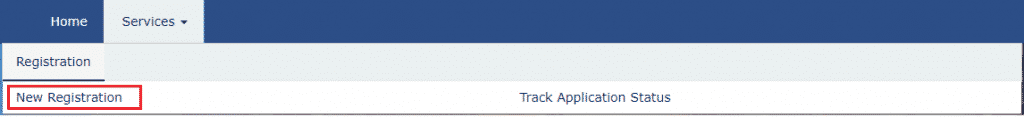

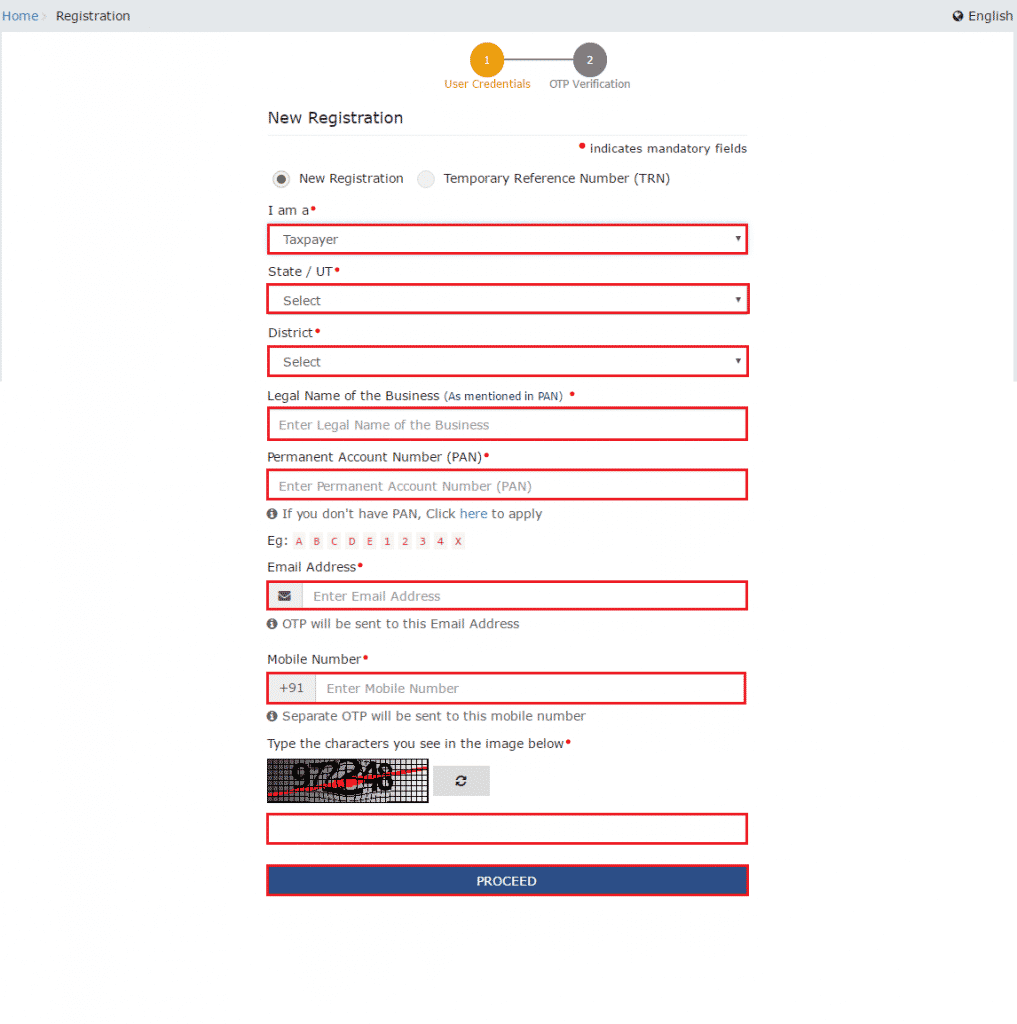

3. The New Registration page is displayed. Select the New Registration option.

3. The New Registration page is displayed. Select the New Registration option.

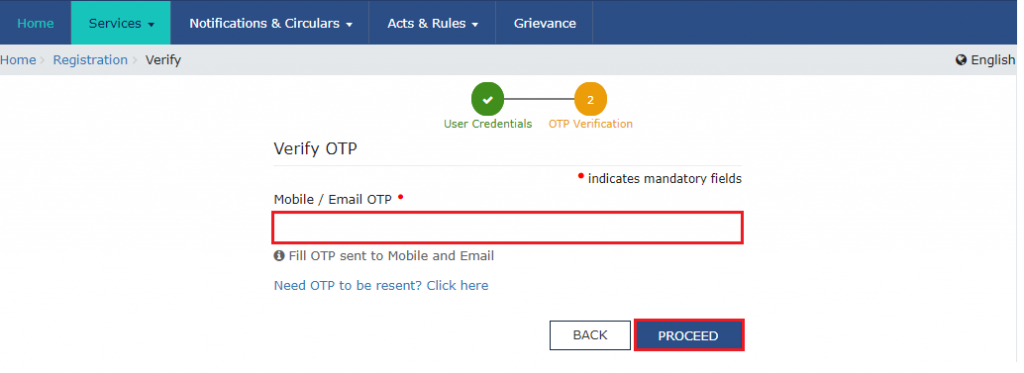

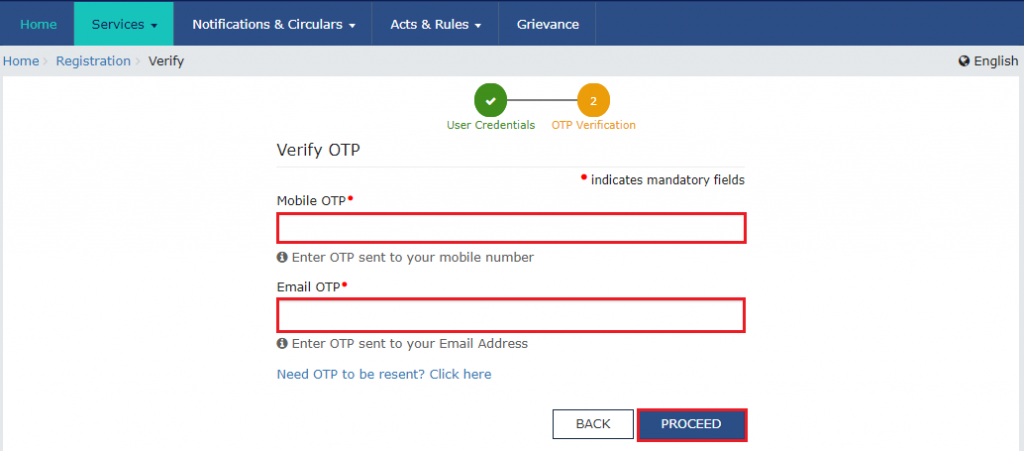

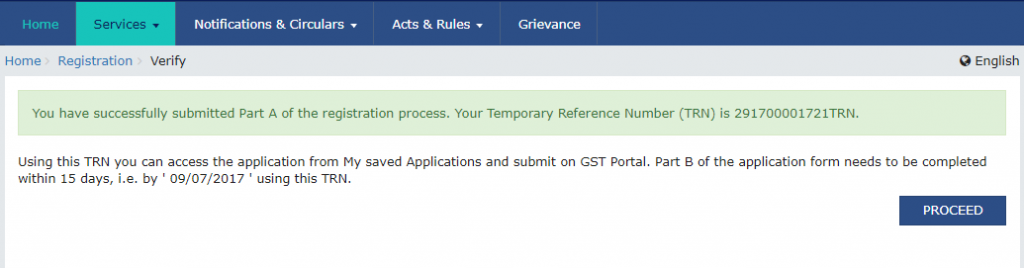

15. Click the PROCEED button.

15. Click the PROCEED button.