GST Registration process in India

Vibcare Pharma

27/11/18

What is GST and GST Registration Process?

What is GST?

It is an Indirect Tax which has replaced a lot of Indirect Taxes in India. GST is one indirect tax for the entire country. The GST (Goods and Services Tax) was passed in the Parliament of India on 29th March 2017 and it came into effect on 1st July 2017.

What are the components of GST?

There are 3 taxes applicable under this system: CGST, SGST & IGST.

CGST: Collected by the Central Government on an intra-state sale (Eg: transaction happening within Karnataka)

SGST: Collected by the State Government on an intra-state sale (Eg: transaction happening within Karnataka)

IGST: Collected by the Central Government for inter-state sale (Eg: Karnataka to Kerala)

GST Registration Process

Perform the following steps for the Registration Application for Normal Taxpayer:

1. Visit the GST Portal.

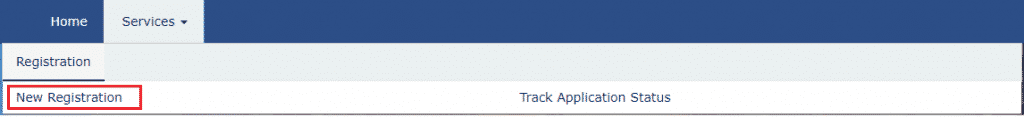

2. Go to the Services > Registration > New Registration option.

The Application form for the GST Registration is divided into two parts as Part A and Part B.

GST Registration Process for Part A:

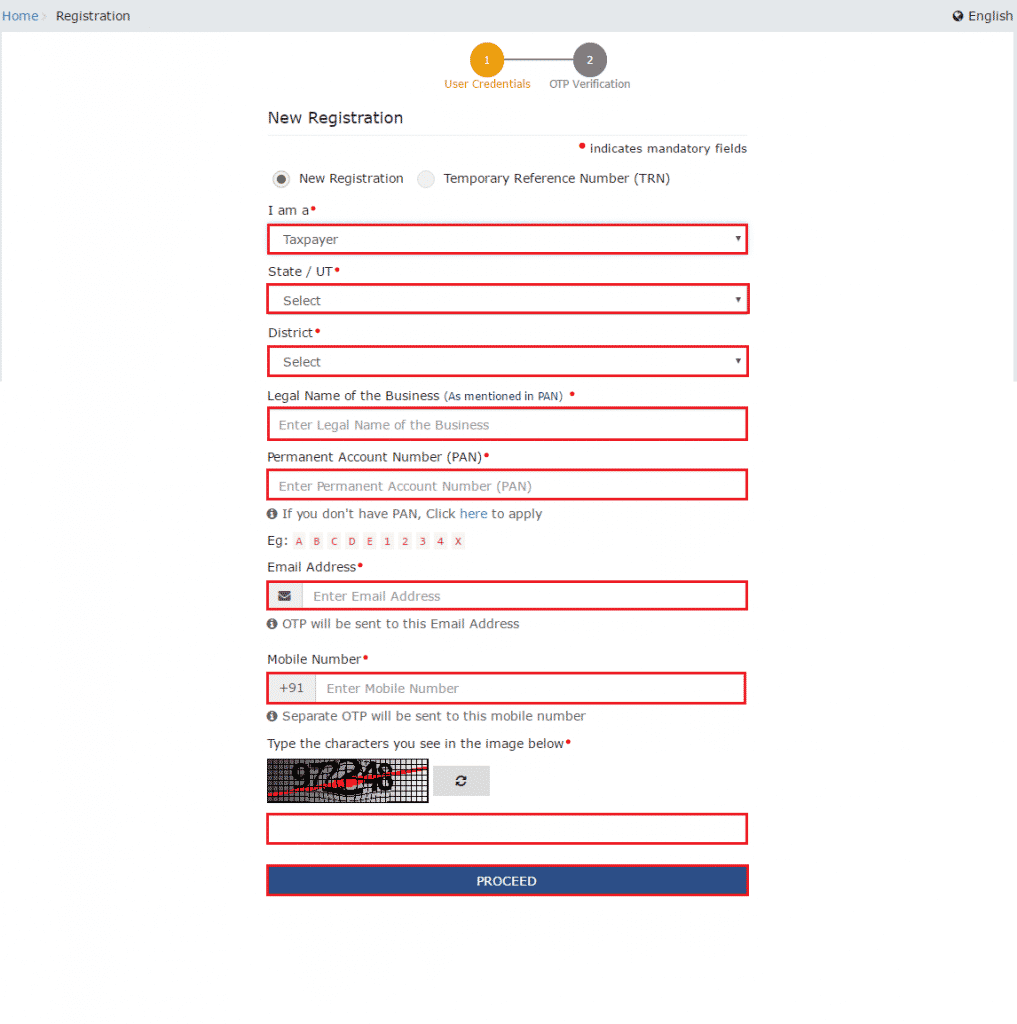

4. In the I am a drop-down list, select the Taxpayer as the type of taxpayer to be registered.

5. In the State/UT and District drop-down list, select the state for which registration is required and district.

6. In the Legal Name of the Business (As mentioned in PAN) field, enter the legal name of your business/ entity as mentioned in the PAN database.

7. In the Permanent Account Number (PAN) field, enter PAN of your business or PAN of the Proprietor.

Note: PAN is mandatory for registration with Goods and Services Tax.

8. In the Email Address field, enter the email address of the Primary Authorized Signatory.

9. In the Mobile Number field, enter the valid Indian mobile number of the Primary Authorized Signatory.

Note: Two different One Time Password (OTP) will be sent on your email and mobile number you just mentioned for authentication.

10. In the Type, the characters you see in the image below the field, enter the captcha text.

11. Click on the PROCEED button.

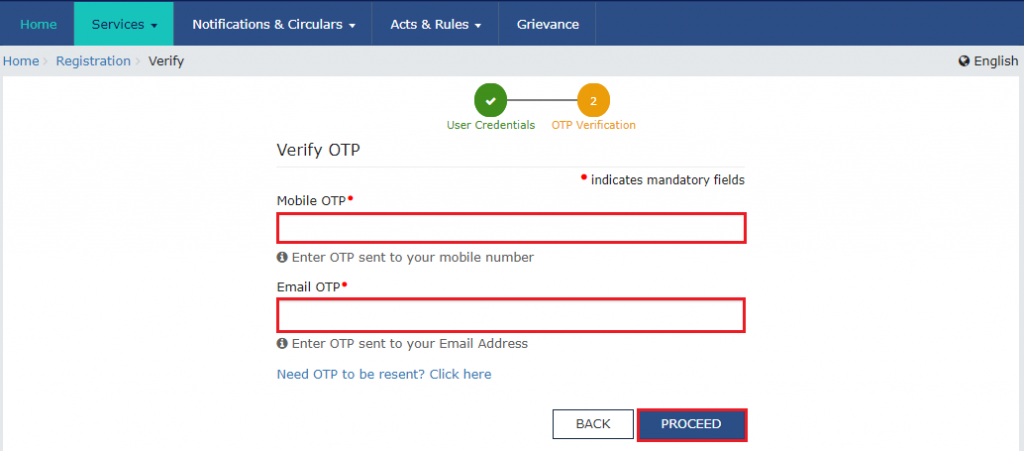

The OTP Verification page is displayed.

12. In the Mobile OTP field, enter the One Time Password you received on your mobile number.

13. In the Email OTP field, enter the One Time Password you received on your email address.

14. Click on the PROCEED button.

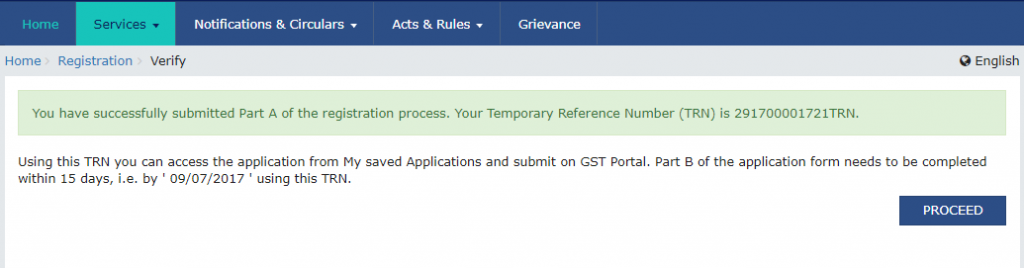

The system generated a Temporary Reference Number (TRN) is displayed.

Note: You will receive the TRN acknowledgment information on your e-mail address as well as your mobile number.

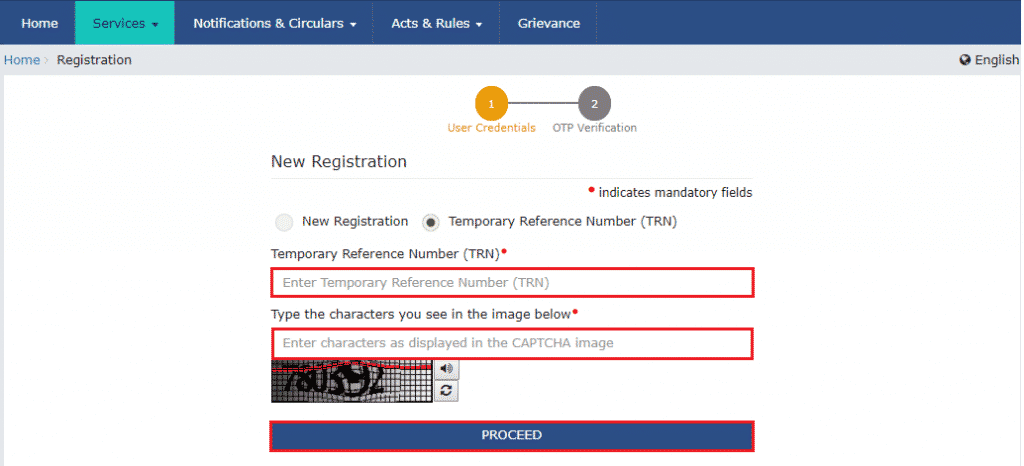

GST Registration Process for Part B:

16. In the Temporary Reference Number (TRN) field, enter the TRN generated and enter the captcha text as shown on the screen.

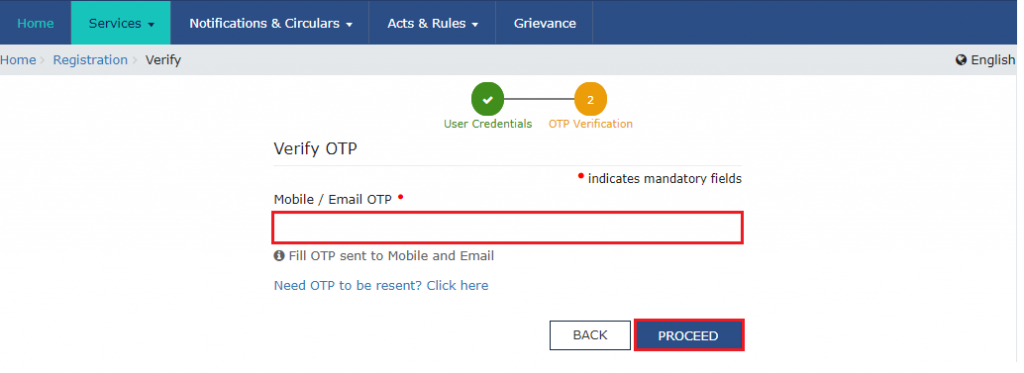

17. Click on the PROCEED button. The Verify OTP page is displayed. You will receive the same Mobile OTP and Email OTP. These OTPs are different from the OTPs you received in the previous step.

18. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note:

• OTP sent to the mobile number and email address are same.

• In case OTP is invalid, try again by clicking the Need OTP to be resent> Click here link. You will receive the OTP on your registered mobile number or email ID again.

Enter the newly received OTP again.

19. Click on the PROCEED button.

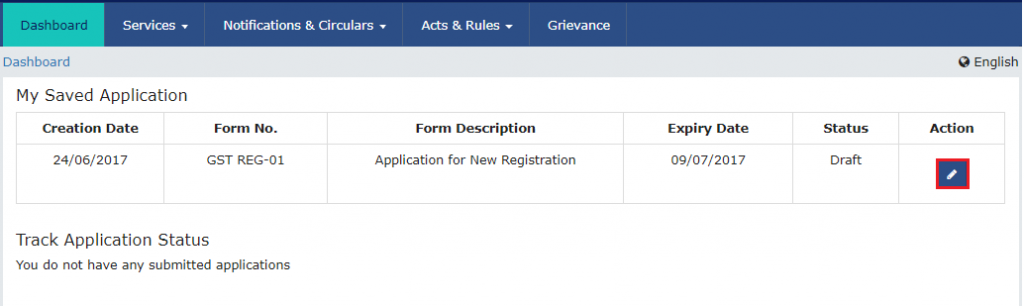

20. The My Saved Application page is displayed. Under the Action column, click the Edit icon (icon in the blue square with a white pen).

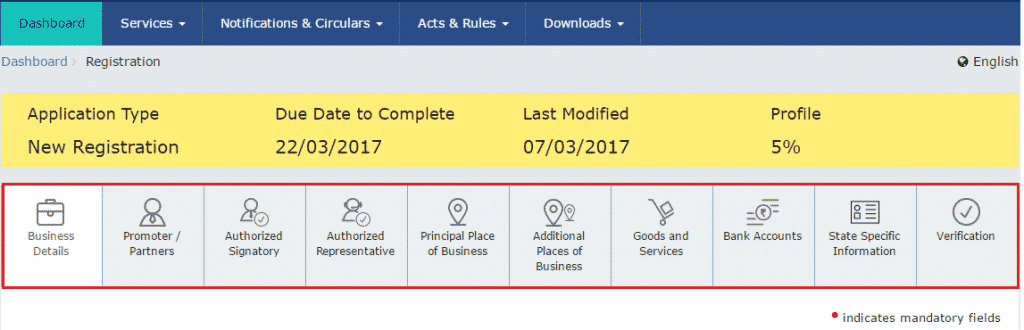

The Registration Application form with various tabs is displayed.

On the top of the page, there are ten tabs as Business Details, Promoter/ Partners, Authorized Signatory, Authorized Representative, Principal Place of Business, Additional Places of Business, Goods and Services, Bank Accounts, State Specific Information and Verification. Click each tab and fill the details.

After filling all the details you will see a success message is displayed. You will receive the acknowledgment in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

You can Check GST Registration Status online by click on the link.

If you are not comfortable with the theoretical part you can watch the video for the GST registration process.

GST Registration Process as a Normal Taxpayer - Part A

GST Registration Process as a Normal Taxpayer - Part B

Documents required for GST registration

- PAN card of the Applicant

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Identity and Address proof of Promoters/Director with Photographs

- Address proof of the place of business

- Bank Account statement/ canceled cheque

- Digital Signature

- Letter of Authorization/Board Resolution for Authorized Signatory

Tax Laws before GST

The following is the list of indirect taxes before GST (Goods and Services Tax):

- Central Excise Duty

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Central Sales Tax

- Purchase Tax

- luxury Tax

- Cess

- State VAT

- Entertainment Tax

- Entry Tax

- Taxes on advertisements

- Taxes on lotteries, betting, and gambling

Copy Link